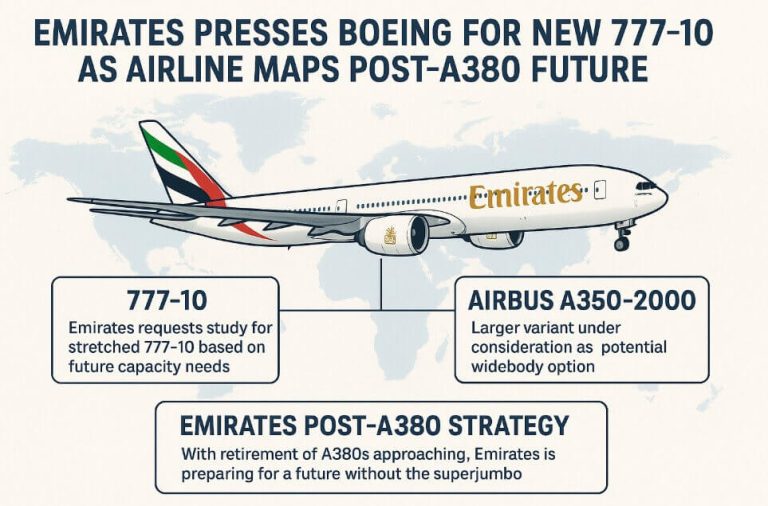

Emirates is sharpening its long-term fleet strategy as it looks beyond the Airbus A380 era, urging Boeing to study a stretched 777-10 variant while tracking Airbus’s early consideration of a larger A350-2000. With its flagship A380 fleet expected to retire in the late 2030s and early 2040s, the Dubai-based carrier is preparing for a future in which no current aircraft can match the superjumbo’s capacity.

The airline’s leadership says that while neither concept fully replaces the A380’s size, both could help fill the gap at Dubai International Airport (DXB), where high-density, long-range flying underpins the network.

Emirates Pushes Boeing for More Capacity

President Tim Clark confirmed that Emirates has asked Boeing to assess a 777-10 stretch based on its need to preserve seat counts once the A380 leaves the fleet. The request followed Emirates’ latest commitment for 65 additional 777-9 aircraft, with first delivery anticipated in early 2027.

Clark said the airline wants a direct role in shaping the proposed 777-10, noting that existing technology makes a stretch feasible. He emphasized that “the GE9X engine has room for growth and that structural conditions support a stretch.”

He reiterated that a 777-10 would be the only near-term platform capable of approaching the seat capacity Emirates needs for its busiest routes. Entry into service would likely fall sometime in the 2030s, though Clark acknowledged that the 777-9 must first complete its long-running certification program. He added that “stretches of existing aircraft typically appear five or six years after initial entry into service,” aligning with Emirates’ planning horizon.

Airbus A350-2000: Still More Questions Than Answers

On the Airbus side, Clark said discussions around an A350-2000 remain limited, with key performance concerns unresolved. He argued that a new powerplant would be required for Middle East operating conditions, saying he does not see the Trent XWB-97 as adequate for the performance Emirates requires.

These concerns are also why Emirates has not committed to the A350-1000. Clark dismissed speculation that an order was imminent during the Dubai Airshow, saying details remain insufficient. He added that despite years of dialogue, “Airbus appears to be advancing in its own direction,” calling the airline’s efforts to secure a larger A350 variant “a consistent struggle.”

Market Signals Point Toward Higher-Capacity Widebodies

Clark expects global demand for larger twin-aisle aircraft to grow as airports worldwide reach infrastructure and slot limits. The A380 demonstrated how high-capacity jets can unlock growth in constrained environments, even if the industry never embraced the superjumbo at Emirates’ scale.

Previous attempts at oversized widebodies—such as studies by Singapore Airlines for enlarged A350 or 777X variants in 2016—never moved beyond concept stage. Yet Clark believes the pressures facing major hubs today will eventually push more airlines toward larger airframes.

Emirates and Safran Invest in Local Manufacturing

Beyond fleet planning, Emirates is taking steps to expand Dubai’s aviation manufacturing presence. The airline and Safran Seats have agreed to build a new aircraft seat production and assembly facility in the emirate, designed to support both retrofit and future line-fit needs.

The site will initially focus on Business and Economy Class seats for Emirates’ ongoing cabin refurbishment program. Safran says the facility aligns with plans to expand regional manufacturing capacity and meet rising global demand for seats. The project supports what Emirates describes as a growing aerospace hub in Dubai, with opportunities to create skilled jobs and attract specialized suppliers.

Construction is scheduled for completion by the fourth quarter of 2027. The facility will span 20,000 to 25,000 square meters and eventually be capable of assembling up to 1,000 Business Class seats per year, with room for expansion.

$10–12 Billion Emirates Investment at Al Maktoum Airport

Emirates also confirmed plans to invest between $10 billion and $12 billion in its future facilities at Al Maktoum International Airport (DWC), where Dubai is developing a new mega-hub as part of a broader $35-billion government-funded expansion program.

Sheikh Ahmed bin Saeed Al Maktoum said the airline’s budget will fund catering centers, maintenance hangars, and essential operational buildings—projects separate from the government-financed terminal infrastructure. These facilities will support Emirates’ future fleet growth as the airport scales toward an initial capacity of 150 million passengers, with long-term plans for up to 260 million.

UK Export Finance recently issued a $3.5-billion Expression of Interest to support British companies participating in the expansion, highlighting growing international engagement in the project.

Sheikh Ahmed said Emirates is “well-positioned to finance its share,” citing strong liquidity and cash flow. He noted that the broader aviation ecosystem will involve multiple stakeholders whose investments will help shape Al Maktoum into one of the world’s largest aviation platforms.