Angelica Goliger, chief economist at EY, said collection of personal income tax (PIT), South Africa’s largest source of tax revenue, has declined in recent years.

Between 2003 and 2012, the number of taxpayers for income tax grew by 7%. But since 2012, some of those gains have eroded, with a -2.1% drop in taxpayer numbers, according to data from Sars.

This is particularly worrying, Golliger said, given that in 2020 there were only 5.2 million individual taxpayers. These 5.2 million individuals, representing about 9% of the population, contribute 40% of South Africa’s total tax revenue. In more detail, about 20% of individual taxpayers contributed to three-quarters of personal income tax revenue in 2020.

She said there were two reasons for this trend.

First, the drop in tax revenue was the result of a weak economy that reduced the ability of companies to grow, raise salaries, and hire people. The outlook for the South African economy is expected to remain weak and the unemployment rate to remain at unsustainable levels – so this trend is likely to continue.

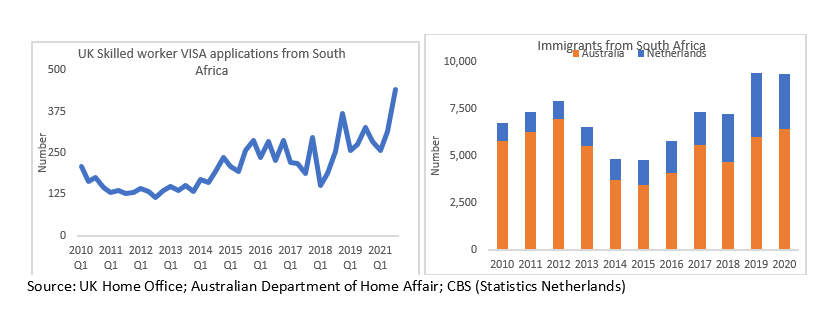

Another factor that has contributed to the decline of individual taxpayers is the emigration of skilled people from South Africa. For example, the United Kingdom, Australia and the Netherlands have recorded strong growth in the number of immigrants from South Africa in recent years.”

So what can be done to change this situation?

The quickest intervention to increase the supply of individual taxpayers, Golliger said, is simply to import more skilled workers. “Visas for skilled foreign workers should be encouraged and expedited,” she said.

Goulger said that accelerating the hiring of foreign workers would benefit the economy for several reasons:

- It will ease immediate restrictions and allow businesses to grow,

- Skilled foreign workers will create direct jobs for other South Africans; And perhaps most importantly,

- South Africans who work with these individuals learn global knowledge and best practices in their respective industries.

We should also encourage South Africans living abroad to return home. When South Africans return, following the wake-up call of family and culture, they bring with them knowledge, experience and access to global markets that can be used to start and grow a local business, she says.

“In addition to the ‘softer’ aspects of lifestyle, we need to create a viable business case for returning South Africans, and this can only be achieved through a growing and vibrant economy.”

Golliger said a growing economy in the medium to long term is the most important factor when it comes to the sustainable growth of private equity groups.

“The IMF decided in its latest Article IV consultation that implementing the economic reform and fiscal consolidation agenda could result in South Africa’s GDP growth reaching 3.6% by 2025, compared to its baseline vision of 1.4%.

“So this would reduce South Africa’s budget deficit from -8.3% of GDP in 2021 to -1.8% of GDP in 2025. There is no way to avoid the hard decisions and hard work needed to help the economy move forward. “

Read: Tax increases to watch for next week — including a fuel tax hike: Nedbank