A Historic Sale for a Struggling National Carrier

Pakistan has finalized the privatization of Pakistan International Airlines (PIA), selling the national flag carrier for Rs 135 billion, or approximately $482 million, in one of the largest privatization transactions in the country’s history. The deal concludes years of debate over the future of the loss-making airline and marks a significant policy shift toward private-sector ownership in Pakistan’s aviation industry.

The sale was completed following a competitive bidding process in Islamabad and is being viewed by policymakers as a milestone in the government’s broader economic reform and privatization agenda.

Competitive Bidding Process in Islamabad

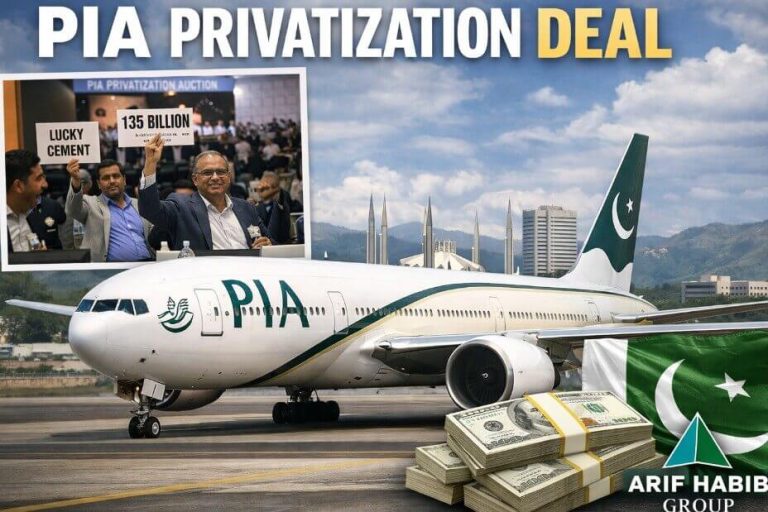

The privatization ceremony was held in the capital and conducted through a live televised auction to ensure transparency. Three pre-qualified bidders participated: a consortium led by Arif Habib, Lucky Cement, and private airline Airblue.

Initial sealed bids placed the Arif Habib-led consortium in the lead with an offer of Rs 115 billion, followed by Lucky Cement at Rs 105.5 billion and Airblue at Rs 26.5 billion. After the bids were opened, the government announced a reference price of Rs 100 billion, allowing the two highest bidders to move into an open auction phase.

During the final round, Arif Habib and Lucky Cement raised their bids incrementally. The auction concluded when Arif Habib submitted an unchallenged bid of Rs 135 billion, securing control of the airline.

Ownership Structure and Timeline

Under the transaction terms, the government initially sold a 75 percent stake in PIA. The winning bidder will have 90 days to acquire the remaining 25 percent shareholding, completing the transition to full private ownership.

The structure of the deal reflects the government’s intent to prioritize the airline’s recovery. Of the proceeds from the sale of the initial stake, 92.5 percent will be reinvested directly into PIA to support operational improvements, while the remaining 7.5 percent will be transferred to the federal government.

Mandatory Investment Commitments

Beyond the purchase price, the new owner is required to commit Rs 80 billion in fresh investment over the next five years. This funding is intended to stabilize the airline’s finances, modernize its fleet, enhance service quality, and improve operational efficiency.

Analysts say the investment requirement will be critical to determining whether PIA can regain competitiveness in a regional aviation market dominated by well-capitalized private and state-backed carriers from the Middle East and South Asia.

Government Assumes Massive Liabilities

A key step in making the sale possible was the government’s decision to assume PIA’s liabilities ahead of privatization. These liabilities totaled Rs 654 billion and had long been a major obstacle for potential investors.

By removing this debt burden from the airline’s balance sheet, the government aimed to reset PIA’s financial position and improve its attractiveness to private bidders. Officials said the move was necessary to ensure a successful transaction after a previous privatization attempt failed last year.

From Aviation Pioneer to Turnaround Challenge

Pakistan International Airlines was once regarded as a pioneer in global commercial aviation, playing a role in the early development of several international carriers. Over time, however, chronic mismanagement, political interference, overstaffing, and aging aircraft eroded its reputation and financial stability.

In recent years, PIA had become a symbol of the challenges facing Pakistan’s state-owned enterprises, relying heavily on government support to continue operations while recording repeated losses.

Implications for Pakistan’s Economy

The successful sale of PIA is being closely watched by domestic and international investors as a signal of Pakistan’s commitment to economic reform. Government officials have credited the privatization commission for managing a transparent and credible process that helped restore investor confidence.

While significant challenges remain in turning around the airline’s operations, the privatization marks a decisive break from decades of state ownership. For Pakistan’s aviation sector and broader economy, the deal represents a test case for whether private management and sustained investment can succeed where government control struggled for years.